Midus Trade Broker Review

Midus Trade Review by Broker-checker.com: Broker overview, legal information, regulations, and client reviews of Midus Trade .

Midus Trade review , legal information, regulations, and customer reviews .

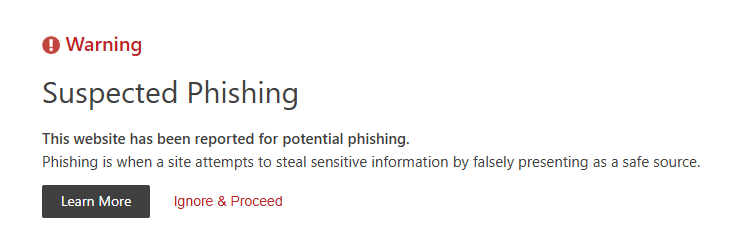

Midus Trade (midustrade.com) is a broker that promises everything: "professional analytics," "transparent trading," "regulation in 30+ countries." But dig deeper, and the grandiose claims are only shadows—questionable registration, lack of licenses, fake addresses, and a convoluted structure. Instead of working with the real market, it's a cleverly constructed scheme to extort money from clients.

This article is a detailed investigation based on verification of registrations, registry data, reviews from affected clients, and an analysis of the platform's behavior.

This article is a detailed investigation based on verification of registrations, registry data, reviews from affected clients, and an analysis of the platform's behavior.

However, upon closer inspection, it becomes clear: behind the veneer lies a classic scam , disguised as an investment platform. This article is a detailed investigation in which we examined Midus Trade's , verified its licenses, examined customer complaints, court cases, and signs of fraud. The findings are disappointing.

Substitution of reality: who is behind Midus Trade?

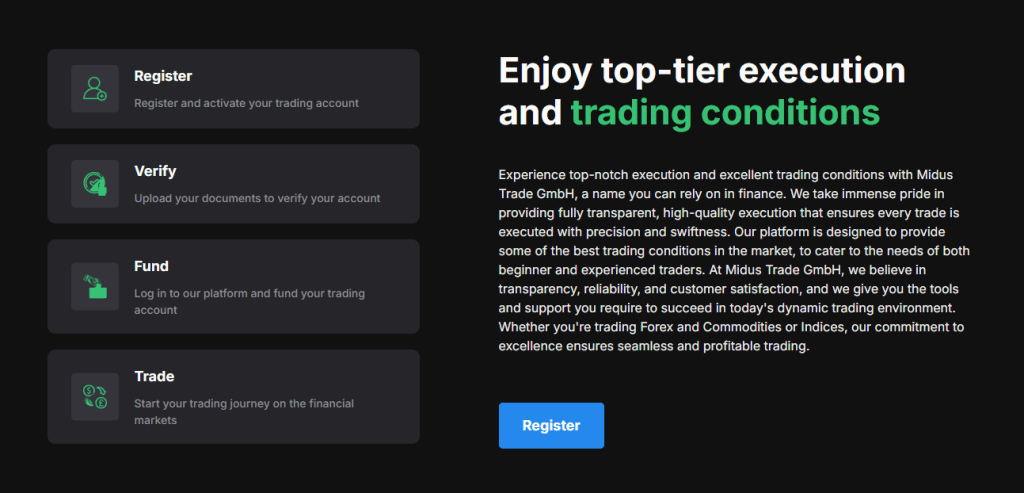

The official website of midustrade.com follows all the templates of a "reputable broker": multilingual support, a businesslike tone, and a well-designed interface. The company presents itself as Midus Trade GmbH — supposedly a European company with Swiss roots and offices in London and Warsaw. But what's the reality?

- , the registered address in London (Freshwater House, 158-162 Shaftesbury Avenue) turned out to be the address of a different legal entity. Midus Trade is not registered at this address.

- A Swiss company with this name does exist , but it's not listed in the Swiss regulator FINMA's database. This means it's not authorized to provide financial services. It's a regular GmbH, registered in Buchs, without licenses, platforms, or clients.

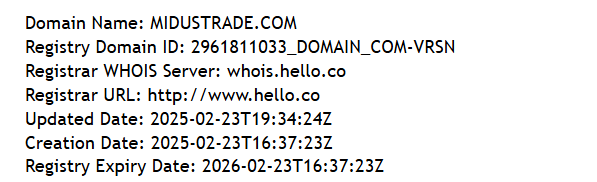

- The midustrade.com domain was only registered in February 2025. Claims of 30 years of experience, "on the market since 2009," and so on are pure fiction.

Lack of Regulation: Everything You Need to Know

The broker's website states that it is "regulated in over 30 countries." These regulators include the FCA (UK), CySEC (Cyprus), ASIC (Australia), BaFin (Germany), and CNMV (Spain). The broker also claims to comply with international KYC and AML standards.

However, the reality is quite different:

However, the reality is quite different:

- on the FCA (Financial Conduct Authority) register . This means it cannot legally provide brokerage services in the UK .

- The CySEC (Cyprus) database is also empty – no Midus, Midus Trade or Midus GmbH.

- The Central Bank of the Russian Federation added midustrade.com to the official list of companies with signs of an illegal forex dealer. This is a clear indication: Midus Trade's activities are considered illegal .

- No matches were found in ASIC, BaFin, KNF and other European databases

The terms of trade are a beautiful wrapper for a trap.

Midus Trade offers "innovative solutions," four account types, thousands of trading instruments, and even a "personal trader." But behind the pretty facade lies a standard, deceptive mechanism.

- The minimum deposit is $2,500. Moreover, you can't use demo mode before opening an account. You're immediately asked to make a "big" deposit.

- The platform is of unknown origin. It's not MetaTrader or cTrader. Trading conditions cannot be verified without investing.

- Returns of up to 18% per annum. No caveats, no risk disclosures. The wording is carefully chosen to convey the message of "guaranteed profit."

- An "analyst" or "manager" will contact you immediately after you top up your account. Their goal is to convince you to invest more. At some point, they disappear, and your funds become inaccessible.

What affected customers are saying

Reviews of Midus Trade began appearing in April–May 2025. As expected, almost all of them were negative. And not just disappointing reviews, but descriptions of systematic fraud:

- Oleg from Moscow invested $5,000 at the analyst's insistence. A week later, the charts "sagged," and he was persuaded to deposit another $2,000 to "average out the position." After that, his account was blocked, and support stopped responding.

- Arina transferred $2,500 and attempted to withdraw $300 in profit. She was billed a "processing fee," then asked for notarized documents, and then completely cut off access.

- Eduard writes that Midus Trade is "a pure scam; I only got my money back through a chargeback." He claims he was pressured, promised insurance, and even a "loyalty gift." He ended up losing $4,000.

Conclusion: Should you trust Midus Trade?

The answer is obvious: NoMidus Trade is not a broker, but a cleverly disguised financial scam. It's unregulated, doesn't disclose ownership information, doesn't provide transparent terms, and doesn't keep its promises. Every client's step—from the first call from a "manager" to the last attempt to withdraw funds—is designed for one purpose: to extort as much money as possible and disappear.

At the time of publication of this article:

At the time of publication of this article:

- the platform is not licensed in any country in the world ;

- Customers are complaining en masse about the impossibility of getting their money back ;

- The Midus Trade website is already blacklisted by regulators , including the Bank of Russia.

Need help from a lawyer

Leave your details and we will contact you

Need legal help? Leave your information and we'll contact you.

I agree to the Terms of Service